Take our UK client Shield Insurance Broker (London) LTD for example

The pandemic and related restrictions hit the economies of many countries hard, but not all of them sank during this period or barely survived, teetering on the brink of collapse. There were those who managed to take advantage of the crisis to take a leap, and it is a significant leap upward. Take our UK client Shield Insurance Broker (London) LTD for example.

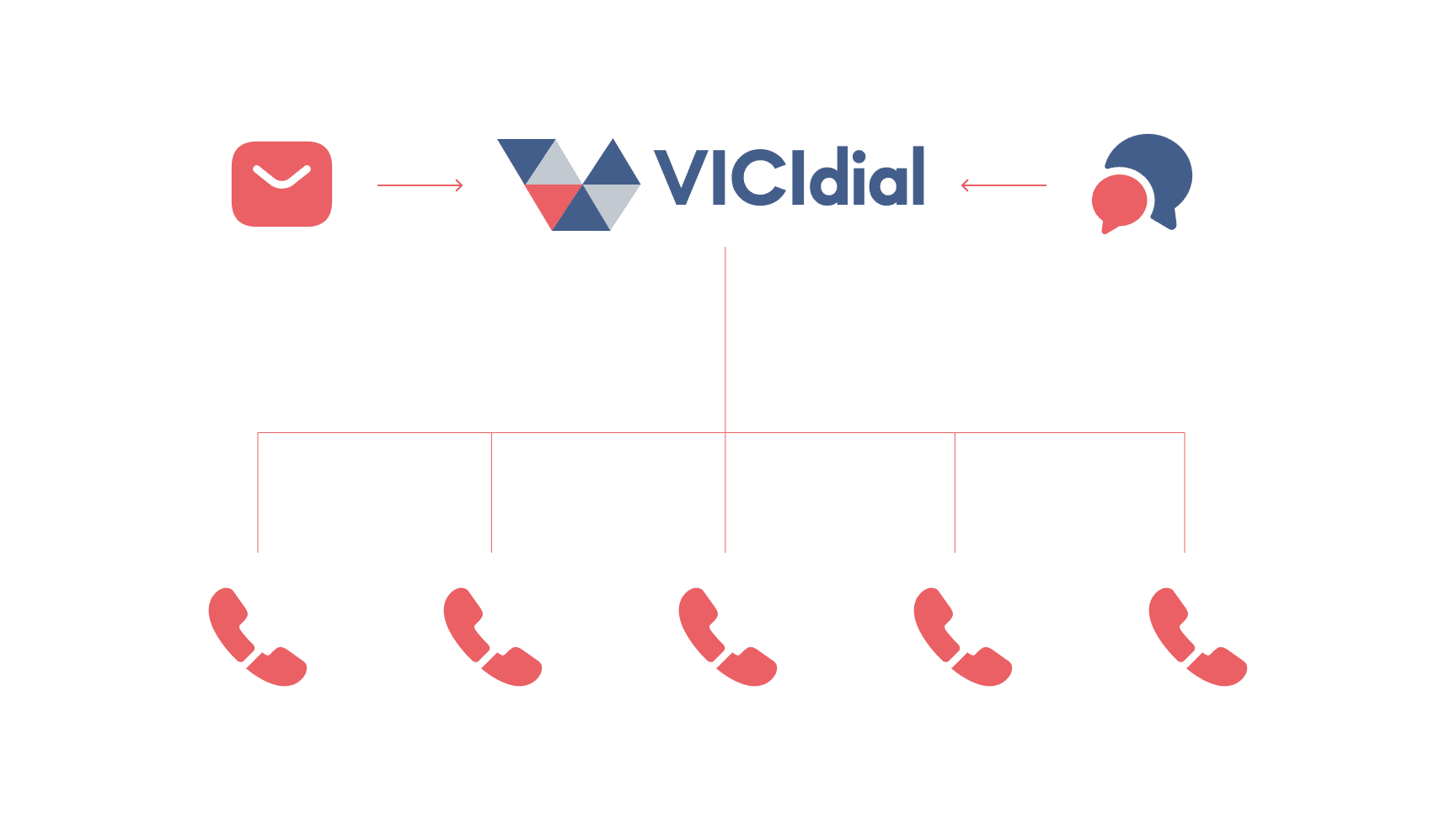

Predictive calling and cloud call center

Greetings to all! I am Alex Trotsenko, head of Againagain.agency, a company providing outsourcing services. For the uninformed, I will briefly explain what is outsourcing in bpo: this is a form of cooperation in which an outside contractor takes on part of the work of an enterprise in order to relieve its employees for more important matters. It’s convenient and much cheaper than having your own in-house specialist, let alone having a team of them.

But I digress, let's get to the point. The crisis caused by Covid-19 affected everyone, including the insurance broker Shield Insurance Broker. The company had been successfully operating on the market since 2016 and had been promoting its products for several years using various tools, mainly by managers whose tasks were calling potential clients, convincing them to buy insurance and creating the application and processing it. As it turned out later, when operating offline, Shield Insurance Broker was not able to take full advantage of every opportunity to promote the company, however, its solid reputation, extensive experience, knowledge of the market and profession still managed to help the company stay afloat confidently. Until the pandemic, when sales plummeted, the manager then decided to contact me.

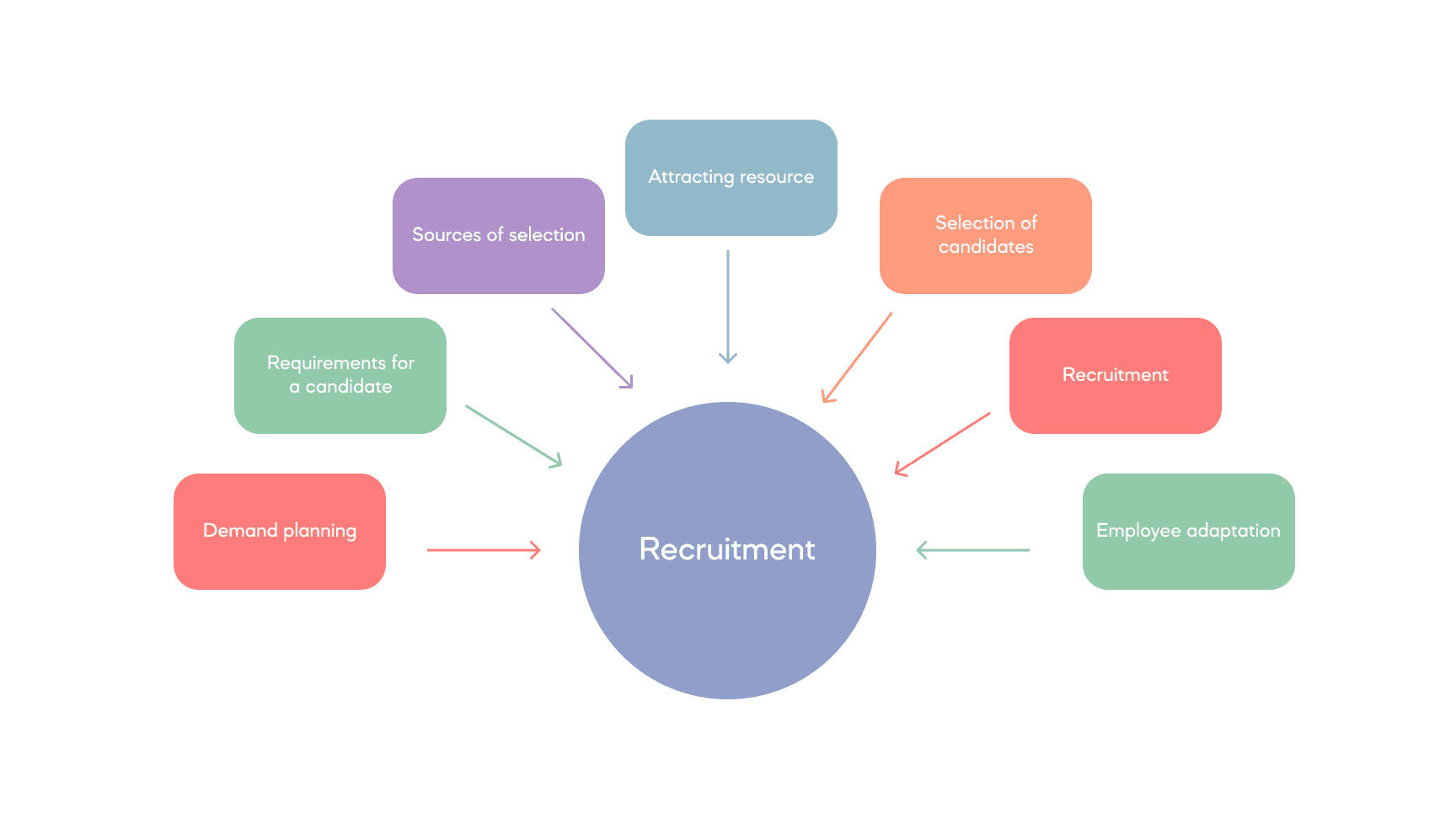

After analyzing the company's previous business practices, the niche it occupied in the market, and the current situation, we proposed:

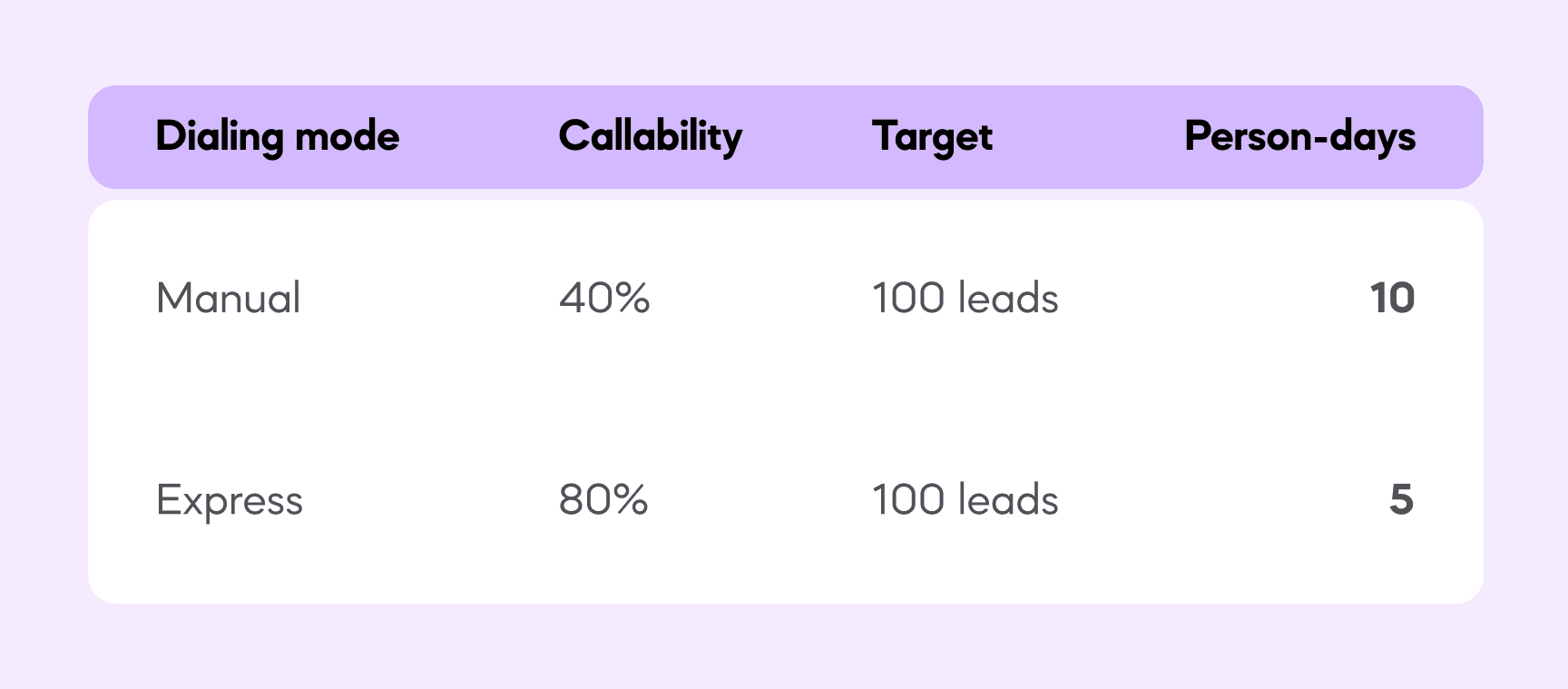

- Promote products through a predictive calling services, such as VICIdial. This system allows managers to use their working time with maximum efficiency by determining when to complete a conversation with one client and connect the call to the next one. It reduces the number of pauses between calls to zero, filters out inactive contacts, and reduces the likelihood of situations occurring when a call is made but there are no available operators on the line. Number databases are called three times faster, and the manager manages to complete three or even four hundred conversations per shift, significantly increasing the percentage of completed transactions while remaining within the same time frame.

- Integrated with Salesforce, this is powerful software that allows effective management of customer information and complete transactions, thereby improving the quality of service. When applied, VICIdial and Salesforce made it possible to automate the first line of sales, turning them into a conveyor belt. Cold calling and application generation were practically eliminated from the managers who were connected at the final stage to complete insurance registration.

- Use a remote call center. It was proven that in the time of coronavirus, it became more convenient than ever, and it also allowed for unrealistic geographical expansion in recruiting employees from anywhere, including outside the UK.

In addition, Shield Insurance Broker required updated databases of potential clients, the compilation of which is also entrusted to Againagain.agency, since we have extensive experience in this area and qualified employees that are capable of solving this problem quickly and efficiently. By the way, I also consider the compilation of such databases to be a bpo segment, since purchased ready-made databases can be of low quality, and their independent compilation requires a lot of time and money, even with involvement of serious fundamental specialists in solving the problem.

All the measures taken increased the dial-up percentage to 85%, which increased the amount of insurance premiums received by 15 times in just the first month.

Three ways to connect with clients

Additionally, we have established communication processes between clients and employees. For this, three channels were used:

- Contextual and targeted advertising on the Internet, setting up clients for communication and giving them the first ideas about the company;

- Actual calls, in which managers must transfer the “warmed up” potential buyers to the status of real ones;

- Mailings and correspondence in the messenger that is optimal for the client.

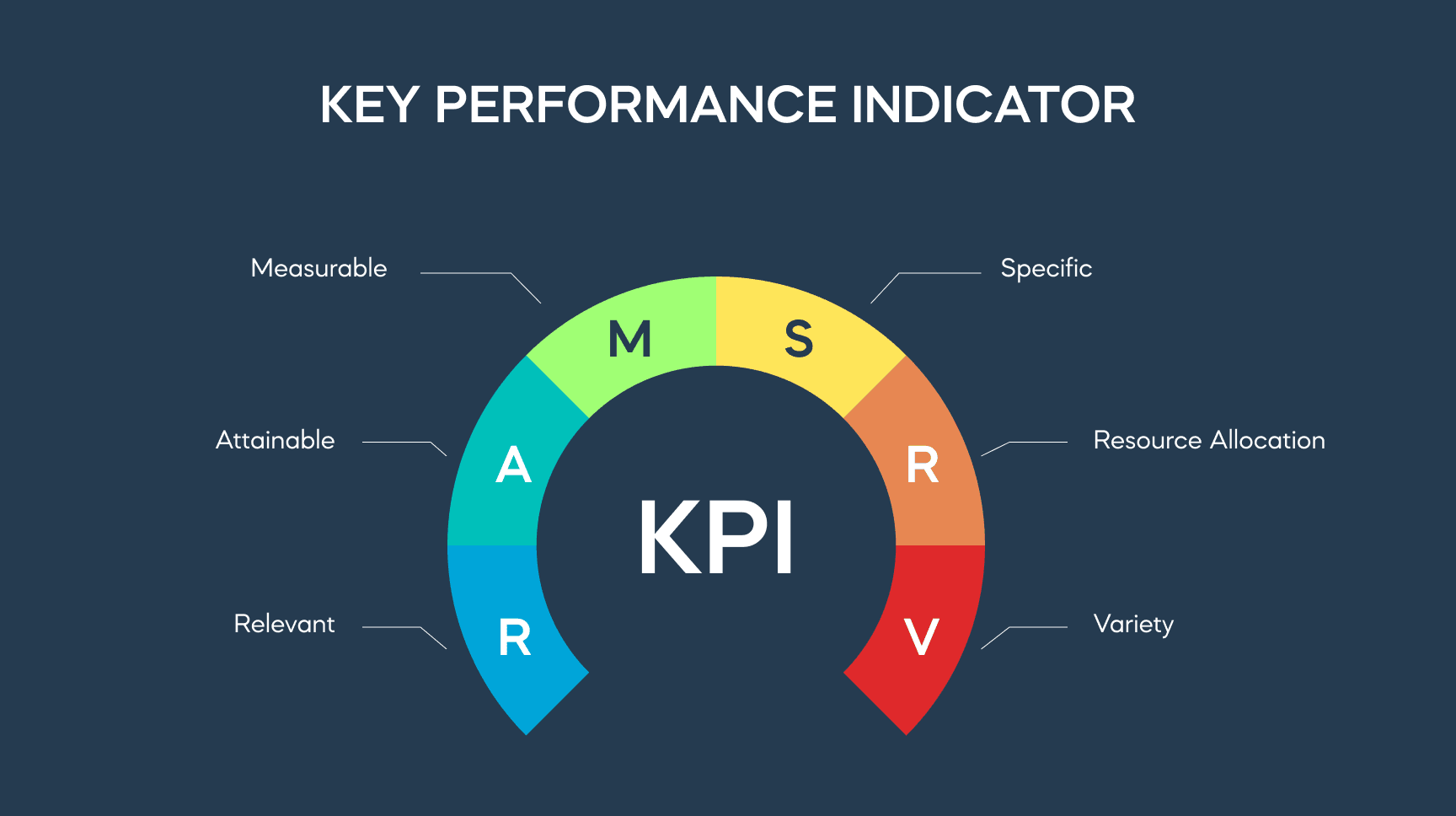

KPI is a necessary assessment system

Sales grew rapidly but were still unsatisfactory, since we knew that we were not using all the possible tools. The final touch was the KPI system, which assessed the activities of the entire team in real time and generated reports for each individual employee by the end of the day. Thus, the performance of all team members remained transparent, controllable and amenable to correction if necessary.

In particular, managers were assessed according to the two following principles:

- Any received application must be prepared for the operator within 15 minutes.

- Once the terms of the contract are agreed upon, the manager has half an hour to send the client a payment link.

Problems and their solutions

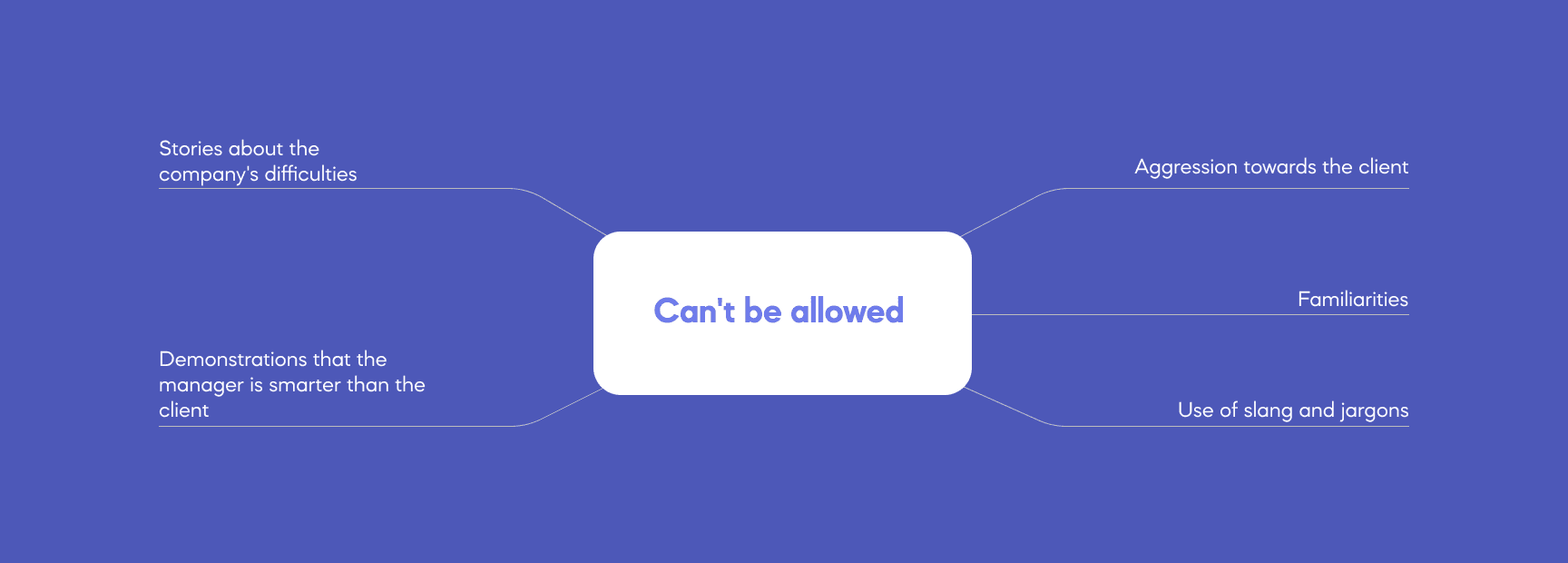

Naturally, not everything always went smoothly. We identified two serious problems and developed a solution for each of them:

-

Internet instability. Unfortunately, this option cannot be controlled even with the best equipment and a good provider. That is why managers received half an hour from the moment they received a lead until they sent the client a link. This allowed them to have some extra time in case the Internet started to slow down.

-

Lack of qualified employees. Not every person is able to quickly get into the rhythm required to handle large volumes of databases. Many employees quit without working even a few days, causing serious staff turnover. Online training had helped remedy the situation, giving new employees an idea of what they have to deal with and preparing them for various emergency situations, as well as a system of payment for mentoring and support that we developed together with the management of Shield Insurance Broker. Finally, a pool of proven employees was compiled, ready to step in in the event of force majeure, so that external circumstances did not interfere with sales.

As a result, at the end of the first quarter, insurance premiums increased 27 times.

Predictive calling reduced more than 3 times Shield Insurance Broker's lead generation costs and doubled its application processing speed. Towards the end of our cooperation, the company was thinking about a bpo call center.

The Christmas weekend period, which fell during one of the months in the quarter, did not result in a significant drop in sales. The average volume of insurance premiums remained virtually unchanged.

Well, Againagain.agency honed its analytical research skills and decided to take a deeper course to study the possibilities of introducing software like Salesforce into the management system of companies whose activities are related to calling.